Multibagger stock Star Housing Finance Company share price increased from 87 to 160 in six months this year

Contents:

Regulatory changes happened across the board in the financial sector. Whether it was NBFC or small finance bank space, the post NBFC crisis made life tough for all players. The companies in the list are covered by a minimum count of 3 analysts. The reason for having a minimum count of analysts for a particular sector is because higher coverage by analysts indicates higher institutional interest in individual stock. The list is based on upside estimated by the analysts, with the highest potential stock coming on the top of the list.

Big bull Rakesh Jhunjhunwala picks stake in this HFC during Q4 Mint – Mint

Big bull Rakesh Jhunjhunwala picks stake in this HFC during Q4 Mint.

Posted: Fri, 22 Apr 2022 07:00:00 GMT [source]

The National Housing Bank is operationalising liquidity infusion facility of Rs 10,000 crore for housing finance companies . Housing finance companies have doubled their share in builder loans to 23.81 per cent by June this year, compared with 12.17 per cent in June 2016. Meanwhile, the share of private sector banks rose to 30.41 per cent from 23.62 per cent, while the exposure of PSBs nearly halved to 24.34 per cent as of June 2019, shows the FSR. RBI said revised draft norms for housing finance companies regulation will be out by Feb 29.

To Read the full Story, Subscribe to ET Prime

The markets on Friday remained subdued and in negative territory, with the Nifty ending the day with a modest loss. No sector is showing any dominance in the markets, except for the auto sector which is indicating signs of improvement. The book value of a stock is theoretically the amount of money that would be paid to shareholders if the company was liquidated and paid off all of its liabilities. Investing.com – Rising oil prices boosted energy stocks, and hopes yet again that a phase one trade deal will finally be struck between the United States and China lifted the rest of the… On the basis of the contract note disclosing the name of the counterparty, settlement of deals, viz.

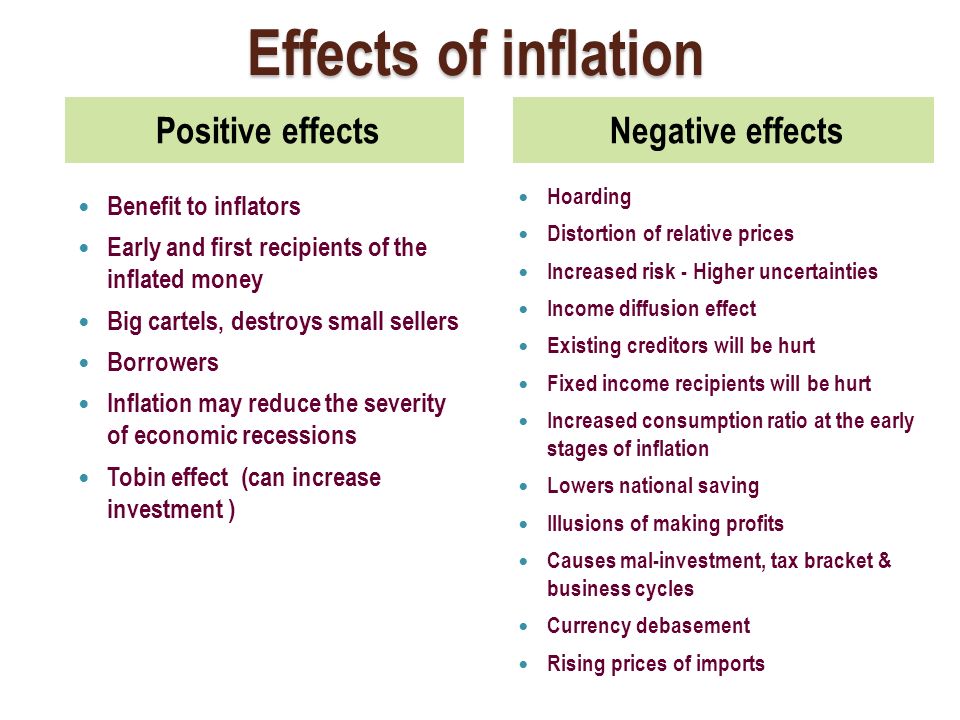

In both cases, what is more important is how efficiently the management uses capital so that shareholder returns are good. The ET screener powered by Refinitiv’s Stock Report Plus lists down stocks with high upside potential over the next 12 months, having an average recommendation rating of “buy” or “strong buy”. These large cap companies have shown an improvement in their SR score at a time when markets have been overwhelmed by news and other developments. Icing on the cake, analysts are revisiting their estimate in light of Q3 results, inflation has been sticky globally and interest rates are still inching upward. ET screener powered by Refinitiv’s Stock Report Plus applies different algorithms & filters to all BSE and NSE stocks, and lists down stocks which fulfill the various criteria as specified into the algorithms & filters. From a new age company which after remaining under pressure for a long time has seen an improvement in its score, to a specialty chemical company have made to the list.

Reliance Home Finance said the report confirmed the company’s internal findings. The process of institutionalisation of the board has been ongoing for the last few years and the recent change at the level of the chairman is a continuation of that, says Gagan Banga. Stocks that were in focus include names like HDFC Bank, which closed with gains of nearly 1 per cent ahead of June quarter results, Adai Enterprises which rose 0.8 per cent, and Adani Transmission which pared gains after hitting a fresh 52-week high. Promoters held 69.47 per cent stake in the company as of 31-Dec-2022, while FIIs owned 7.35 per cent, DIIs 5.95 per cent.

INVESTING

Hampton Financial Corp. is a private equity firm, which seeks to build shareholder value through long-term strategic investments. The firm, through its subsidiary, engages in the wealth management, institutional services, and capital markets activities. It also operates as an investment dealer and provides investment advisory and brokerage services. The company was founded on September 10, 2014 and is headquartered in Toronto, Canada. Investing.com – U.S. equities were lower at the close on Monday, as losses in the Oil & Gas, Financials and Utilities sectors propelled shares lower. Investing.com – U.S. equities were higher at the close on Friday, as gains in the Oil & Gas, Financials and Industrials sectors propelled shares higher.

HollyFrontier Corporation share price live 36.39, this page displays NYSE HFC stock exchange data. View the HFC premarket stock price ahead of the market session or assess the after hours quote. Monitor the latest movements within the HollyFrontier Corporation real time stock price chart below.

You can find more details by visiting the additional pages to view historical data, charts, latest https://1investing.in/, analysis or visit the forum to view opinions on the HFC quote. On the basis of random checking, we certify the statement in paragraph 7 above. We further report that to the best of our knowledge and according to the information and explanations given to us and as shown by the record examined by us the figures shown in Parts A, B, C, D, E, F, G, H, I, J and K of the statement hereinabove are correct. The trust or the securitisation company undertaking the issue in which investment has been made is not engaged in any business other than the business of issue and administration of securitisation of housing loans. Likewise, in last 5 years, this stock has delivered 135 per cent return to its shareholders.

About the Company

Housing finance companies should ensure that the transactions entered into through individual brokers during a year normally do not exceed this limit. However, if for any reason it becomes necessary to exceed the aggregate limit for any broker, the specific reasons therefor should be recorded, in writing, by the authority empowered to put through the deals. However, the norm of 5% would not be applicable to a housing finance company whose total transactions in a year do not exceed Rs.20 crores; and to housing finance companies’ dealings through Primary Dealers. On the lists is the financial services companies which has one being a biggest financial creator and second being from a company which has redefined profitability in the world of retail industry. These companies have come on the list because their scores have inched up and also their prices have moved up in the last one month.

ET screener powered by Refinitiv’s Stock Report Plus lists down stocks with high upside potential over the next 12 months, having an average recommendation rating of “buy” or “strong buy”. For the last one month, Nifty has been under pressure, whether it is due to rising interest rates or due to pressure on Adani stocks, volatility with bears on the driving seat has been the order of the day. In such times few stocks across different market caps have been able to keep their head above water, as they have been able rise marginally in a market where the majority of stocks have been coming under pressure. These large cap companies have shown an improvement in their SR score at a time when bears are ruling the street. All thanks to global developments, market breadth and all other market parameters have moved back into the correction zone. Shares of Aptus Value Housing Finance India Ltd plunged 5 per cent in Thursday’s trade after the housing finance company denied a media report that suggested financial services firm Cholamandalam was eyeing a majority stake in it.

Charter Communications: Stock Has Limited Upside (NASDAQ:CHTR) – Seeking Alpha

Charter Communications: Stock Has Limited Upside (NASDAQ:CHTR).

Posted: Tue, 24 Jan 2023 08:00:00 GMT [source]

In a filing to BSE, the HFC said it was not part of any such negotiations/events as mentioned in the news report. Cholamandalam Investment also denied the report saying it had not expressed any interest in the past or present in acquiring Aptus Value Housing Finance India. The focused mutual funds have the mandate to invest in 30 stocks. The schemes have the freedom to invest across market capitalisations and sectors. The category is typically recommended to aggressive investors who want to bet on a concentrated portfolio.

U.S. shares higher at close of trade; Dow Jones Industrial Average up 2.99%

The normal distribution in statistics price of Star housing finance has been increasing for almost seven years now. The past returns are no guarantee of future returns, but in the investment world, if the past returns are good, there is a good probability of high returns in the future as well. The company has a market capitalization of only ₹266 crores, and it is a small-cap company. With the fundraising in place, there is a good probability of high returns on the capital in the future because of the growth in the rural geographies as per the management of the company.

Traditionally, any value under 1.0 is considered a good P/B value, indicating a potentially undervalued stock. Market cap or market capitalization is the total market value of all of a company’s outstanding shares. The central bank said that HFCs can either take exposure on the group company in real estate business or lend to retail individual home buyers in the projects of group entities, but not do both. The HFC had on Monday raised Rs 834 crore from 21 anchor investors, allocating 2,36,26,500 shares at Rs 353 per share. Every sector has different operating conditions which have high correlation with returns companies in that particular industry are able to generate. Whether it is ROCE, ROE or net margins all is dependent on the underlying business.

The bigger question is how sustainable that number is as that is what determines whether they are able to generate long term wealth or not. The price-earnings ratio is a company’s share price to the company’s Earnings per Share. The ratio is used for evaluating companies and to find out whether they are overvalued or undervalued.

This is putting pressure on the stock prices of various companies. On Wednesday, Kotak Institutional Equities suggested that Aptus would have been a good fit for Chola in many ways. It suggested that while Aptus brings in a high-yield housing/MSME lending business, near-term profitability would have been marginally diluted for Chola due to Aptus’ current lower capitalisation levels.

140 levels and any major dip in the stock should be seen as buying opportunity as stock may go up to above mentioned levels in next one to two months. On Monday, September 7, the stock had seven ‘buy’ and seven ‘outperform’ recommendations on the publicly available Reuters Eikon database. As per the agreement, Indiabulls Housing will originate retail home loans as per jointly drawn up credit policy and retain 20 per cent of the loan in it’s books and 80 per cent will be on HDFC books.

- Of all the stocks, which our algorithms come up with, we took companies from, FMCG, software, financial services and speciality chemical.

- Central Banks globally have started hiking interest rates in response to the high inflation.

- A record of broker-wise details of deals put through and brokerage paid, should be maintained.

- The company has a market capitalization of only ₹266 crores, and it is a small-cap company.

It is a small cap HFC stock having a market capitalisation of Rs 1,213.38 crore. It is a large-cap HFC stock having a market capitalisation of Rs 4,75,526 crore. IDBI Capital recommends buy the stock of HDFC with a target price of Rs 3,140 apiece for 21% potential gains. EHFL on Friday said it has partnered with the country’s largest lender SBI for co-lending towards priority sector home loans to self-employed entrepreneurs and salaried customers. Emkay Global Financial Services is bullish on HDFC with a 12-month price target of Rs 2,320, indicating an upside of over 12 per cent from the current market price of Rs 2,067.

Within the overall ceiling of 5 per cent for total exposure to capital market, the total investment in shares, convertible bonds and debentures and units of equity-oriented mutual funds by a housing finance company should not exceed 20 per cent of its net worth. There are some businesses which require a constant dose of capital and banking is one of them. There are some which may require a higher amount of capital but that would be a one time requirement setting up a fertilizer plant.

- The list is based on upside estimated by the analysts, with the highest potential stock coming on the top of the list.

- The recent merger between pure-play home financier HDFC with HDFC Bank will only bolster the trend, the agency noted.

- Besides, the business put through any individual broker or brokers in excess of the limit, with the reasons therefor, should be covered in the half-yearly review to the Board of Directors.

- There are some businesses which require a constant dose of capital and banking is one of them.

It said the COVID-19-induced slowdown is likely to impact housing finance companies and pose several other challenges. Banks and non-banking financial institutions have been reluctant to provide loans to the real estate sector citing risks amidst the pandemic, while buyers have also remained financially stressed. The price-to-book ratio is a company’s current market price to its Book Value.

Different industries have different operating matrices which have high correlation with the kind of ROE which they generate and how sustainable that number is. Enterprise Value is a measure of a company’s total value, often used as a more comprehensive alternative to equity market capitalization. Enterprise value includes in its calculation the market capitalization of a company but also short-term and long-term debt as well as any cash on the company’s balance sheet. Similarly, in the last seven years, the stock price has increased from ₹16 in March 2015 to ₹160, which is a return of almost 900%. This stock has been a multibagger in the long term and is performing well recently as well. The stock price of this company has performed really well on the bourses.

These large cap companies have shown an improvement in their SR score even in volatile times and their stock price has gained. The reason for the increase in the stock price is due to the issue of preferential shares of ₹21.6 crores to various shareholders from the BFSI space. The preferential shares of the company were allocated at a price of ₹135 per share.